Investing Like Einstein

If Einstein were alive today, what would he think of our investment markets? He is vaguely attributed to have said that compound interest is the “most powerful force in the universe” but the evidence supporting this attribution is weak.

However, he would surely find it curious that we now live in a world of negative interest rates, where more than US$2 trillion has been invested in negative bond yields and banks are charging interest rates on deposits. Although the word deflation is constantly used in the media, the reality is still inflation, so whether measured in nominal terms or real terms there is no doubt that we live in a time where a certain group of borrowers are able to get paid to borrow money.

Since the driver of these interest rates is the cost of time, the financial sector has accidentally created a way for money to reverse the effects of time.

Besides being surreal, why is this important?

The obvious answer is that no serious investor should want to invest their assets into negative return assets if there are better alternatives. It is both a pessimistic view of the world and an inefficient use of assets.

Large companies are also taking a cautious view of the world, preferring to spend on share buybacks rather than new investment, with a record US$900 billion spent on buybacks and dividends in the US alone in 2014. In this case, share buybacks create the illusion of growth by shrinking the denominator, the number of shares outstanding. At an individual firm level, this can sometimes be the right strategy but can society overall shrink its way to prosperity?

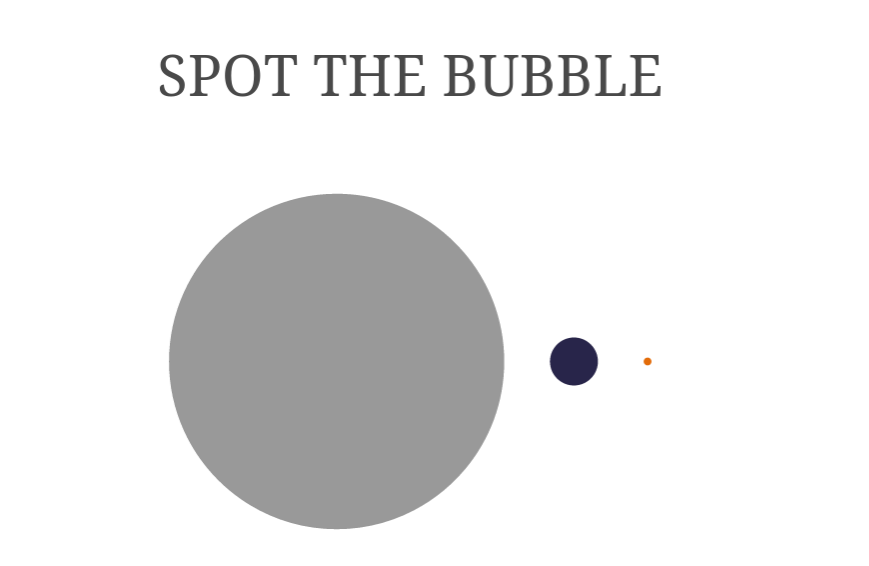

For context, it helps to look at the size of investment at the opposite end of the investment spectrum, early stage companies focused on growth. Overall venture capital investment in the US was a record US$48 billion in 2014 and a closer inspection of the data shows that early stage deals received US$1.3 billion.

In today’s world, when the opportunities to create value through innovation are more exciting than anytime in history, society is investing the largest amount of money in the most pessimistic assets with the lowest expected returns and investing the least amount of money in the assets with the largest potential to create new innovation and highest potential returns. These are symptoms of a deeper problem: failure of the imagination.

As an early stage venture investment fund, this actually works better for us because it means less competition. Ultimately, however, early stage investment is not a zero sum game and so we would rather have more people invest to create more overall value.

Finally, if the perception is that there are no assets that can generate meaningful returns given the risk, investors are better off giving their money away because there is no shortage of social issues which have not been solved by markets.

Circling back to Einstein, some people may argue that he would be in favour of the current asset allocation by society because it appears to be made by rational decision making in a scientific manner. But his comments suggest otherwise. In Einstein’s own words, “imagination is more important than knowledge.”