Leonardo da Vinci Venture Capital and Startup Lessons

Our firm name Fresco Capital is inspired by the timeless fresco paintings of masters like Leonardo da Vinci.

You may wonder “how can there be such a thing as Leonardo da Vinci venture capital and startup lessons?” as he lived hundreds of years before our modern startup ecosystem.

Yet Leonardo da Vinci left us a record of his observations and opinions in amazing notebooks. Many of his attitudes and habits are explored in How to Think Like Leonardo da Vinci. Here are five Leonardo da Vinci venture capital and startup lessons:

1. Curiosita: insatiably curious approach to life.

Curiosity beats raw intellect for anything related to startups because you need to keep asking questions. Once you assume that you know all the answers, the company is probably going to fail. On a related note, it’s hard to be curious about something when purely motivated by money. It’s much easier when you are driven for the sake of learning and money is the by-product.

2. Dimonstratzione: commitment to test knowledge through experience.

Learning through books and from others is helpful but there is no substitute for learning through experience. The scientific method of formulating a hypothesis and then testing it is extremely valuable during this process. Also, the experience of surviving and growing through the failures of experiential learning leaves scar tissue, which makes you stronger in the future. Of course, it doesn’t always feel good at the time.

3. Sfumato: willingness to embrace ambiguity, paradox, and uncertainty.

Startups are defined by ambiguity, paradox and uncertainty. There is never enough data or evidence to make any important decision obviously clear except in hindsight. Every choice has both pros and cons. Most of the time, the only choice is to move ahead into the unknown while maintaining an open mind about feedback just in case you need to change course quickly.

4. Arte/Scienza: balance between science and art, logic and imagination.

Some people get obsessed about the technology in startups. In the process they forget about people and emotions. True success requires a blend of science and art, and this is especially true in the early stages of building a company. To build something with global scale, a basic human emotion needs to be satisfied at some point in the value chain, even if it can be described by cold, hard logic.

5. Connessione: recognition and appreciation for the connectedness of all things and phenomena.

Nothing exists in isolation. Decisions, actions and results always have context. Startups by definition have limited resources and so it is especially important for them to leverage the surrounding ecosystem and do more with less. As part of that, systems thinking has to include a strong appreciation of time, including when to move quickly and when to be patient.

There are many modern theories about venture capital and startups but the reality is that the core principles for success have been around for centuries. These Leonardo da Vinci venture capital and startups lessons illustrate that he would fit right into the current global startup ecosystem.

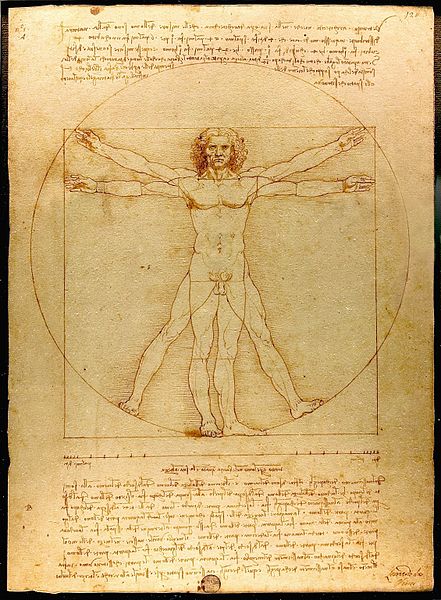

Photo credit: Luc Viatour