Transforming Venture Capital, One Person at a Time

Some people think venture capital is just fine and doesn’t need to change. Others want to turn it into a hyper liquid automated platform.

It’s time to call bullshit on both views.

Traditional venture capital needs to be transformed and the process will happen one person at a time.

I gave a presentation to a group of family office investors and corporate investors about the “Do’s and Don’ts of Venture Investing” earlier this year using martial arts training as a metaphor. It covers a lot of basics, with details here and here.

The discussion below starts with some of the traditional issues around risk and return, then moves on to ideas about how to transform venture capital.

At the black belt level, the emphasis shifts to higher level training, including awareness of self and the environment.

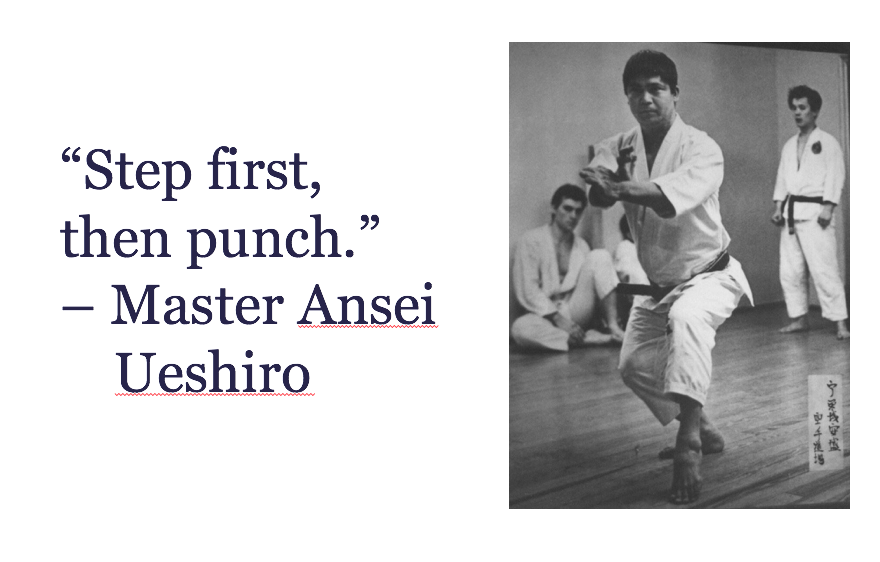

A typical mistake for a beginner in karate is to punch before stepping. This results in no power — as we learned in brown belt, strength starts from the bottom and flows upwards. It seems easy which why it’s actually difficult and in fact many people simply don’t even notice the mistake. Even with the incorrect technique, it still feels correct.

Getting the timing right in venture investing is similarly a challenge. The biggest mistake is to sell too early. The only thing worse than missing out on a billion dollar investment is being an early investor and then selling out to a new investor for a small profit and missing out on the much bigger gain. I know of one investor who came in very early into Alibaba only to sell soon just to get the money back because of concerns about risk. Whoops.

Of course, there are certain situations where it’s better to sell. This can happen especially when a wave of lemming behaviour overcomes investors to jump into a theme.

There’s no formula for getting the right timing to sell, but compared to all other investments venture capital is about long-term returns, so you should be thinking in terms of years and decades, not day trading.

The foundation of looking at the risk vs. return over time is to always evaluate decisions as if you were investing for the first time. In reality, that’s difficult in venture capital because of the knowledge built up over time after an initial investment and the overall lack of liquidity. Still, it helps to set the right framework. A more detached assessment of risk vs. return tends to lead away from binary all or nothing decisions and towards a more measured approach.

Of course, the process is not all about numbers. In fact, understanding the motivation of founders, other investors and of course your own goals is critical. If the company has been grinding it out for 10+ years and everyone is ready to move on, it may not matter that the best financial decision would be to continue for another 10 years because from a motivation perspective the journey has finished. Conversely, if the company has just received a lucrative M&A offer, this might be just the catalyst for a highly motivated founder to push for a more aggressive scaling up strategy and reject the early exit. Human inputs can be the most important factors when it comes to evaluating risk vs. return.

People are surrounded by external distractions. In addition, our minds are constantly creating internal distractions. This noise stops us from concentrating.

One description of traditional martial arts is “moving meditation”. Embedded in this description is the idea of having an empty mind. The first step is to navigate external distractions. The more difficult challenge is to manage internal distractions. Rather than trying to push the distractions out of our mind with mental energy, which is impossible, the training emphasizes acknowledging distractions and then being able to let go of them. Empty mind is not a static state of being, it is a dynamic process.

At first glance, it seems ridiculous that an empty mind would be an important skill for venture investing. Traditional wisdom suggest that experience, especially domain expertise, is necessary to be a successful venture investor.

The problem with experience is that it is actually one form of noise. The deeper the experience, the louder the noise. If you have 23 years of experience building microcomputers and some kid comes along with an idea for a personal computer, all your experience screams “impossible, no way this will work”. If you’ve spent all your career selling packaged software and someone suggest selling software for a monthly subscription, your instincts react immediately that customers simply wouldn’t trust software that they don’t own. If you’ve built billion dollar satellites and a young team proposes to create a network of cubesats, the first reaction is to treat it as a toy project. That’s the voice of experience speaking.

An empty mind allows even experienced venture investors to stay open to new opportunities. You can’t ignore your experience — those thoughts will always be there. Instead, acknowledge them, let them float away, and then let your empty mind stay open.

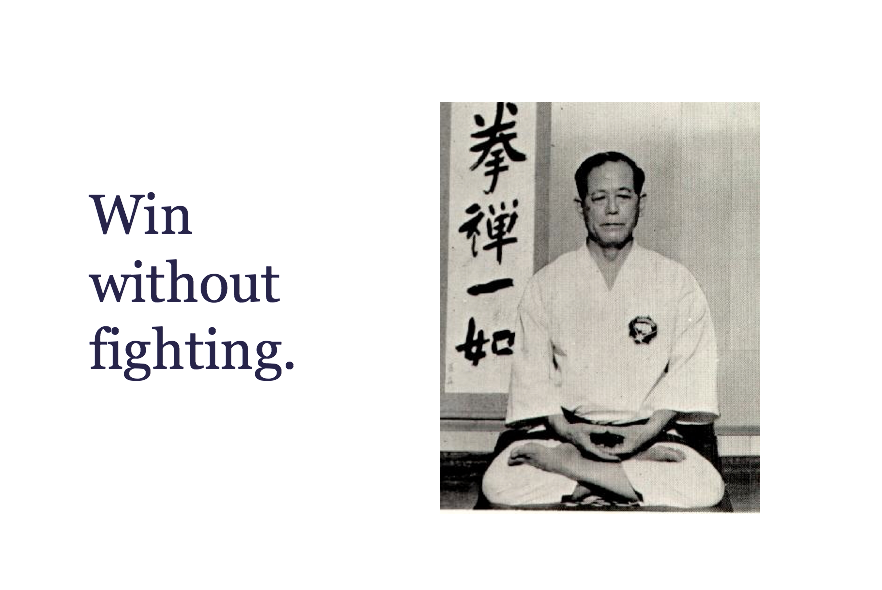

The common assumption is that martial arts focuses on fighting. But upon closer inspection, there’s a clear emphasis on peace by many traditional martial arts teachers. Fighting is the last option of traditional martial arts.

Many startup founders and venture investors make heavy use of war and sports metaphors — destroy the competition, hunt down customers, don’t be a loser.

Words and metaphors influence behaviour and actions. So by definition people being led by these words will be approaching the world with at zero sum perspective. For them to win, others have to lose. Zero sum thinking implies a lack of new value creation. If you believe that technology is supposed to create new value, not simply take value from others, then by definition these zero sum metaphors should be rejected.

Of course many others will continue to view the world from a zero sum perspective no matter what you do. Instead of wasting your energy on constantly fighting with them, focus instead on partners who you can trust.

Trust is much easier to build with aligned incentives and shared values. Aligned incentives alone may not be enough if the partner is going to find a way to cheat at the first opportunity. Shared values create great intentions but without aligned incentives, there may be no tangible outcomes. So it’s important to have both.

The right partners will help you reach your goals faster no matter what games others are playing.

Reaching a black belt level in traditional martial arts is not an end goal. It is more like reaching the starting line of the journey. At the higher levels, this learning includes the willingness to embrace paradox in many ways.

Traditional karate training obviously places a big emphasis on learning the basics. The only way to do this is through repetition so that it becomes automatic.

But the ultimate goal is not to become a clone of others from the past. Instead, every single karate student has a unique signature style. If you try to develop your signature style at the white belt level, you’ll just be fooling yourself. The style develops naturally over time without any extra effort through the process of repetition.

Learning from other investors about venture investing is a great shortcut. After all, nobody has the time to invent it all from nothing. To this day, I’m still reading Fred Wilson and Brad Feld on a regular basis.

You should absolutely learn from what venture investors are sharing both in public content and in private meetings.

But a copy and paste approach is unlikely to be optimal. Every venture investor’s background is unique. Each era is different. And it’s all path dependent. As an example, one of the big differences about our team at Fresco Capital compared to most other venture investors is our global cross-border approach. Most early stage investors are local and that works for them. We’ve chosen to be different precisely because of our background and experiences.

Instead of a copy and past approach, better to take the time to find trusted partners and work together with them. Co-create solutions that meet your unique needs. The ideal partners adds strengths to fill your gaps. This could be knowledge, network or other resources.

A key part of our global approach is working with local partners who are on the ground everyday in the local market. So just being global is not enough — working with these local partners is a key differentiation.

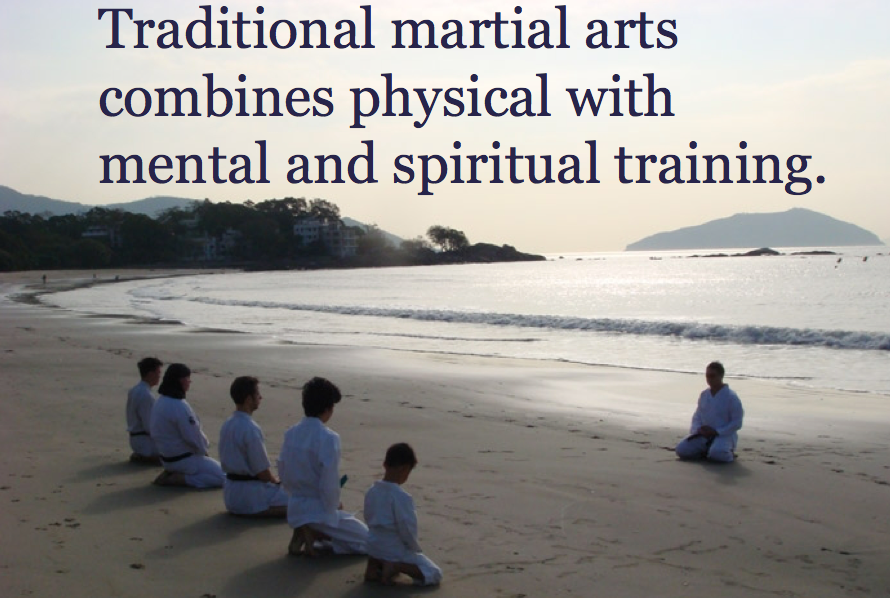

Martial arts starts with physical training. At a certain point, however, the mental and spiritual aspects of martial arts become more important than the physical training.

This doesn’t mean that the physical training is not important. The physical training is a gateway to reach the mental and spiritual benefits. Rather than being independent, they are integrated.

Venture investing starts with financial returns. This has to be the foundation. And many people do view venture investing as a box that takes money in and spits money out a few years later.

But this view overlooks the potential direct and indirect benefits beyond just the box of cash perspective. There can be positive effects on revenues, efficiency, and speed for related businesses. There may be harder to measure, but perhaps even more important, soft benefits such as upgraded team skills, improved innovation and entirely new business units which grow larger than existing businesses. Most importantly of all, all of this investment in innovation can, and should, be used to actually improve people’s lives.

It’s important to emphasize that these additional benefits are unlikely to materialize if financial returns don’t set a strong foundation. So start with the financial returns. But don’t limit your imagination to a box of cash. The ultimate potential is much bigger.

Venture capital investors are always questioning and challenging assumptions in other industries. It’s important that venture capital itself faces the same kinds of questions and challenges.

While industry insiders are looking for new ways to differentiate, a little extra push from external forces can only help accelerate the process.

Ultimately, the best way to learn something is share it with others. In karate, this means training new students and then having them train students. This passes on the physical skills plus also the philosophy and values. None of this can be truly learned by reading a blog post or watching a video.

There is no substitute for person to person training.

Historically, venture capital was a very secretive industry. Knowledge was not shared and venture capital firms put a lot of efforts into controlling information flow. This started to change in the past 15 years as the industry started to open up. Blogs and in person events have allowed people to learn more about venture investing. But the reality is that most of the activity is still behind closed doors.

True innovation requires an open ecosystem, and venture capital also needs to join this trend. So our view is that successful venture investors should not be trying to hide the secrets of investing from others.

We believe there is tremendous value to be created in sharing knowledge about venture investing with others. More and more new investors are getting involved in venture capital. Without effective co-operation, that money may be completely wasted on bad investments.

Rather than hoping that other investors fail, we believe that the startup ecosystem desperately needs more high quality investors. This is not a zero sum game.

Of course, the challenge is to identify the right kinds of partners. There has to be an alignment of both values and incentives.

There’s a saying in karate: “a black belt is just a white belt who never gave up”. Learning to learn is the most important lesson of all. I’m still learning plenty about both karate and venture capital.

It’s this learning that is the secret power of how we can transform venture capital one person at a time.