Why Are Fat Startup Rounds Back?

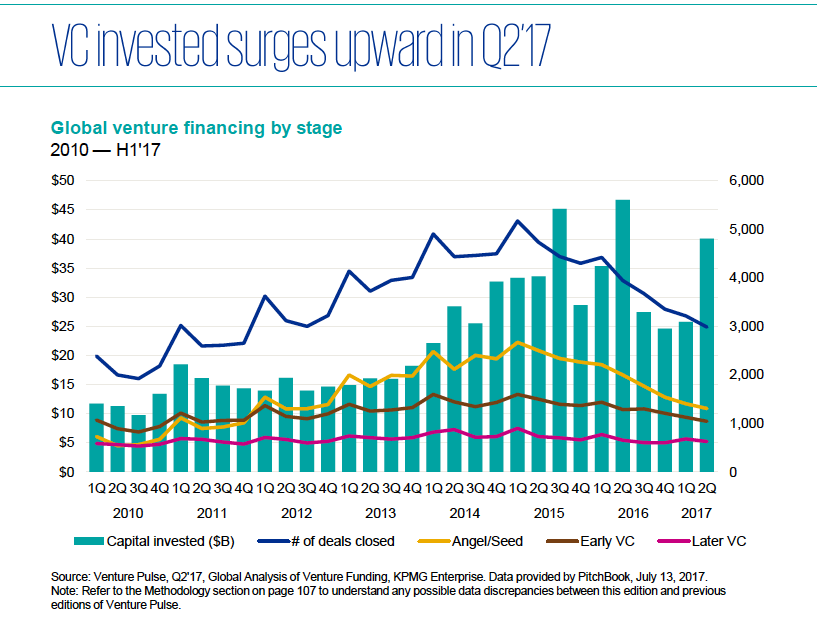

Headline numbers look good for global VC investment during the 2nd quarter of 2017 but the more interesting story is what’s going on underneath the surface.

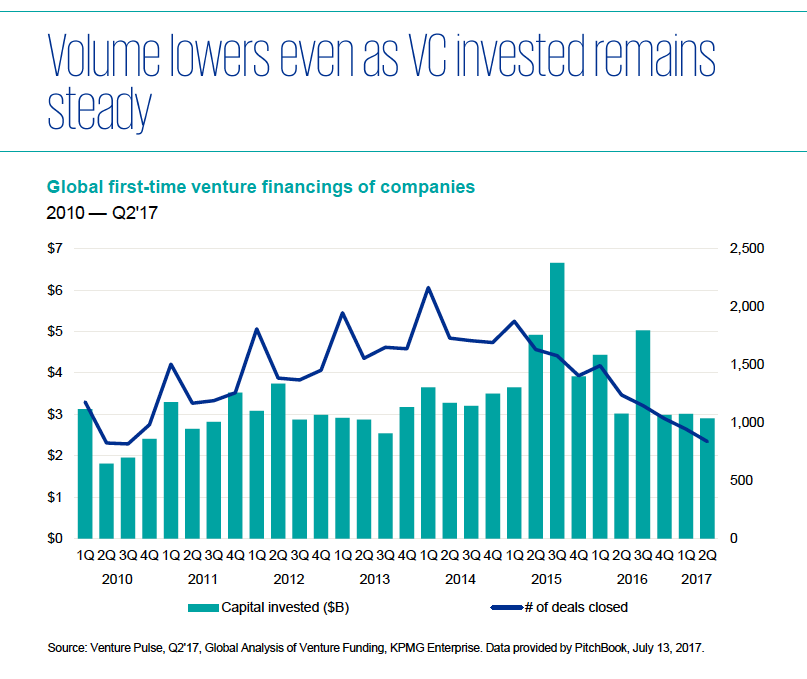

Digging into the details, below is the trend for first time investment activity (thanks KPMG + Pitchbook for crunching the numbers).

Even taking into account stealth rounds which have not been announced, the number of new companies has not been keeping up with the $ invested. And if you take the data at face value, the number of rounds is back to levels not seen in several years.

Instead, VC investors have been adding more to existing companies.

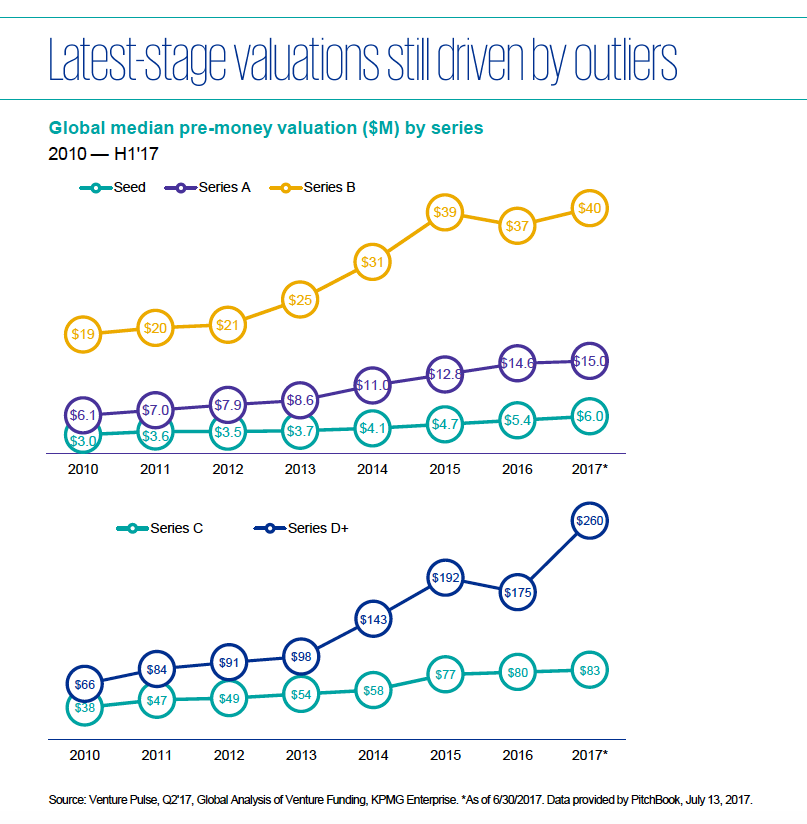

The increase in round size can be seen in most rounds, with the obvious outlier being the late stage Series D+. The above numbers are median, so the $40M figure likely understates the outliers.

The median pre-money valuations above tell a similar story:

fat rounds are back.

Why?

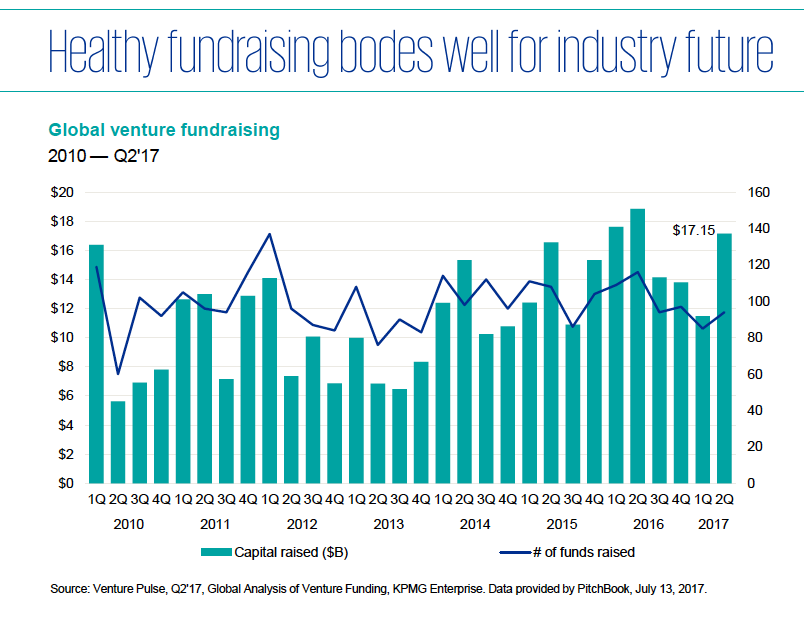

First, VC funds are cashed up.

VC funds are continuing to raise $ at an impressive rate. If you’re familiar with the timeline of how VC funds deploy capital, one guarantee is that managers will invest this money. They’re not going to give it back next year saying “I can’t find anything to do with it.” The capital will be around for, oh, about the next 10 years. VC funds will invest in something.

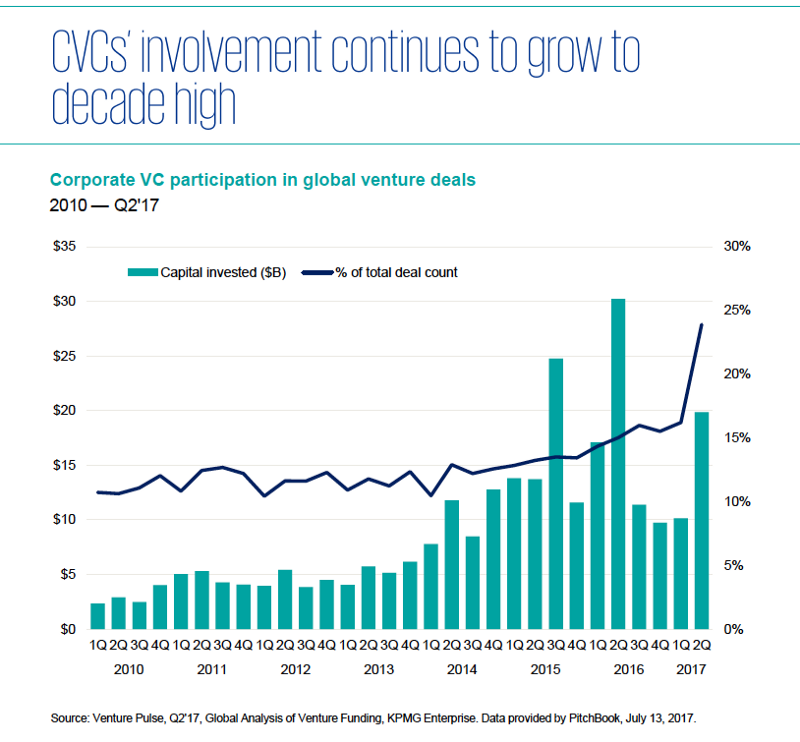

Second, corporate VC funds are having a big impact.

The rate of participation has been increasing steadily and in this last quarter they have been even more aggressive. Many of these funds are structured with external investors, including the headline grabbing Vision Fund. So like traditional VC funds, the capital should be around for several years (as contrasted with pure balance sheet investment from corporates which can be harder to predict over time).

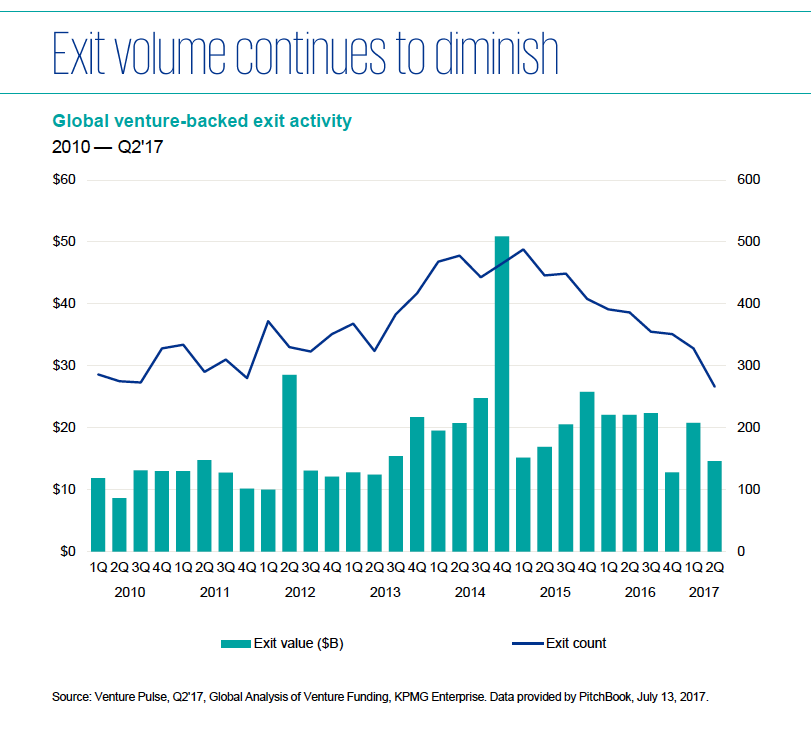

Third, exit trends have been lukewarm for VC backed startups.

This has meant that late stage companies are staying private for longer. Those fat rounds are in some sense becoming short-term substitutes for M&A and IPO exits.

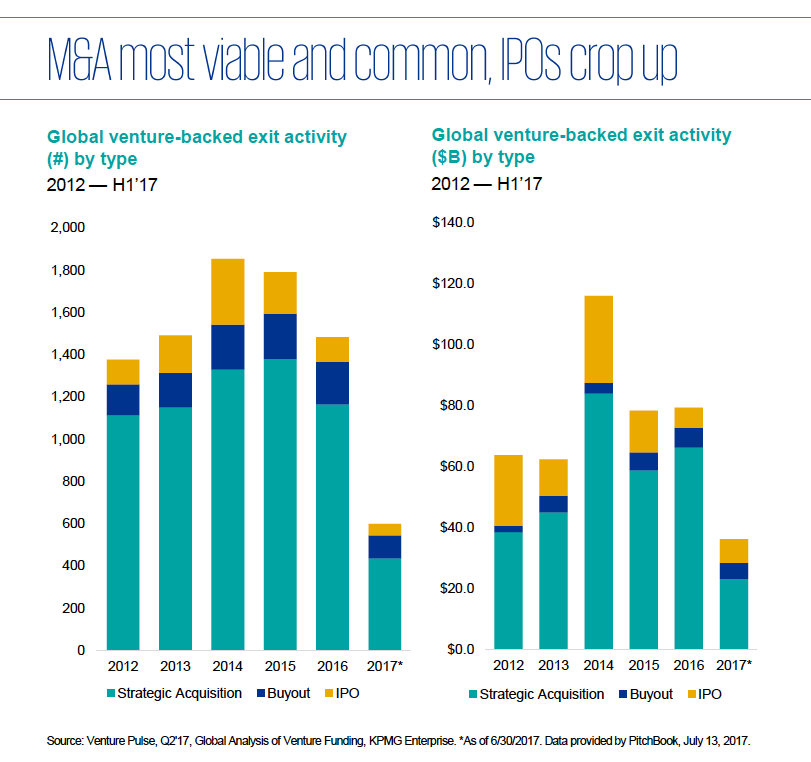

So there’s an interesting paradox.

On the one hand, corporate VCs are more active than ever before and investing aggressively in late stage fat rounds.

On the other hand, corporate M&A activity is not keeping pace.

Based on the lifecycle of capital raised, expect VC funds to continue investing in existing companies.

However, if market sentiment deteriorates, fat startups will become the victims of cap table recaps. There will be money, yes, but the terms will be harsh.

For startups, VC investors, and LP investors in VC funds, now would be a good time to remember the benefits of capital efficiency. For startups especially, make sure you understand the terms of rounds, not just the headline valuation.

Fat startup rounds are back. Let’s make sure we’re building healthy businesses because it sucks to be a fat, dead startup.

Why Are Fat Startup Rounds Back? was originally published in Fusion by Fresco Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.