Three Ingredients of an Edtech Ecosystem

Over the past few years, I have had the privilege of observing and participating in education and technology ecosystems all around the world. Whether I am traveling from, to, or currently in any given city, I am frequently asked, “What do you think of the startup scene there? Are there even any edtech entrepreneurs?” This led me to wonder, what exactly makes an edtech ecosystem possible? From Silicon Valley to New York, Hong Kong, Beijing, Manila, Tokyo, Australia, and beyond, where in the world are we most likely to find the next innovative technology solutions for education?

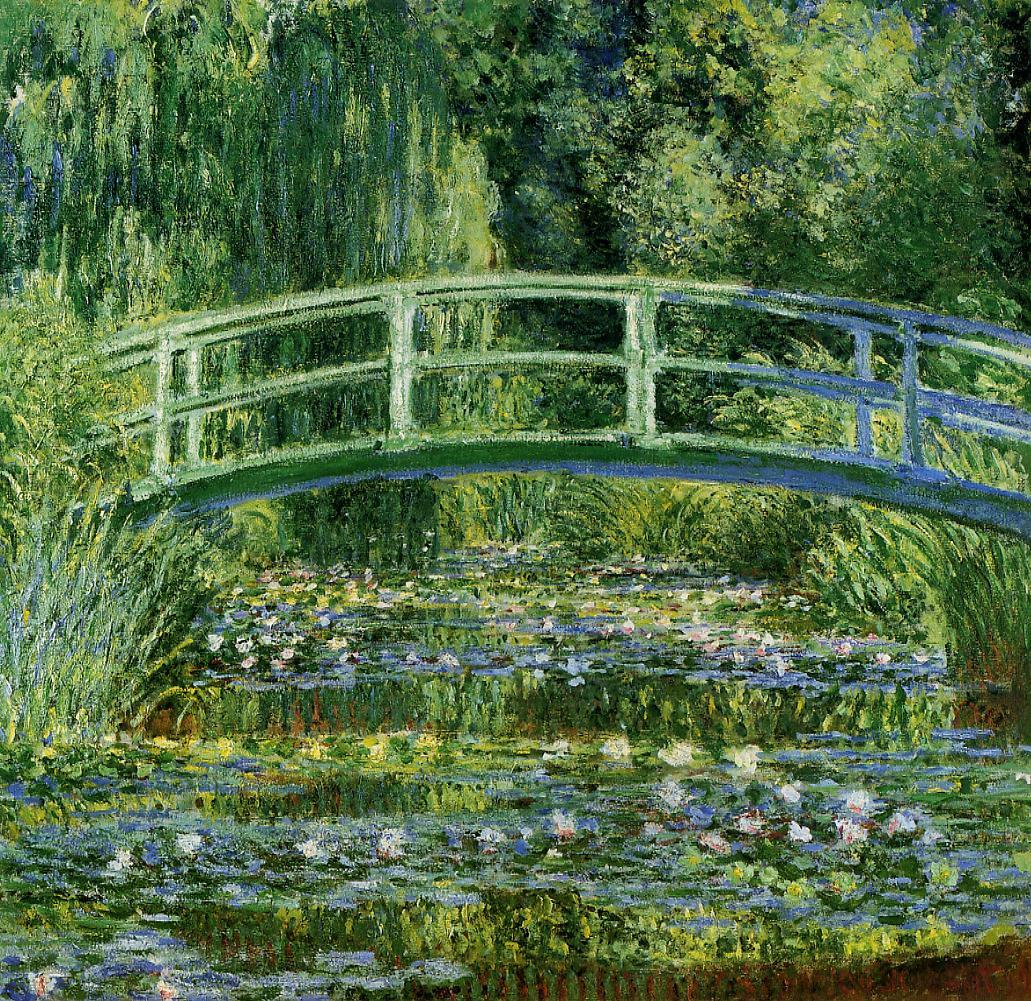

Indeed, just as a painter cannot create a masterpiece with a canvas, paint, and brushes, a technology entrepreneur cannot meaningfully transform education without a few key ingredients. When we’re evaluating opportunities around the world for both ourselves as investors and on behalf of our portfolio companies as businesses, I have noticed there are three key ingredients that, when present, make it truly possible for an edtech ecosystem to thrive.

1) People — with experience in both education and technology.

This means there should be both an existing start up ecosystem, and a mechanism by which digital natives are spending time in traditional education environments. Teach for All programs are a prime example of a community mechanism that takes ambitious individuals who have grown up with technology integrated into their everyday lives (Facebook, mobile, e-mail, etc) and places them inside of underserved, largely analog education environments, where they are in a position to directly witness the ways in which technology can make learning more efficient and effective.

2) Connectivity — to the internet.

Technology cannot impact education if individuals do not have access to the internet. For years, even some of the most technologically advanced economies in the world have not had reliable internet connectivity in schools and homes. This has been even worse in the developing world where a complete lack of infrastructure has prevented individuals from getting online. However, with now more mobile phones than people in the world, individuals even in third world countries have access to the internet. This means people can access unlimited information through their own devices, without relying on government bureaucracy to build the necessary infrastructure. As BYOD becomes more of a reality, it will be interesting to see the ways which innovation from the developing world may potentially leapfrog the US and other more developed ecosystems.

3) Capital — dedicated to the edtech sector.

A healthy ecosystem requires sophisticated capital that understands the risks and challenges of investing in technology for education. Investors must have enough experience in the sector to ask the right questions, but not so much experience that they think they know all the answers. They must be motivated by both returns and scalable impact so that capital will flow to the right teams and opportunities. Without funders and founders that can see beyond the alluring “let’s help children” and “do good” phraseology traditionally used to draw capital into the nonprofit education sector, entrepreneurs will not be forced to develop truly viable and innovative solutions.

Just like artists, education entrepreneurs are everywhere. However, without a few key elements in their surrounding environment, their talent may forever go untapped. Part of our goal as global investors is to not just observe these ingredients at work in ecosystems of varying levels of maturity all around the world, but to also play an active role in connecting the dots across ecosystems so they can benefit from each other’s unique strengths and weaknesses. That way, innovation in education can truly occur anywhere, and everywhere.