Don’t Meet With an Investor Unless They Match These Three Criteria

Over the past few years I’ve had the opportunity to work with hundreds of early stage companies looking for funding. They all seem to approach fundraising the same way: make a big list of investors, ping their network for warm intros, and take every meeting with any VC that replies. Unfortunately this is not an efficient way of doing things.

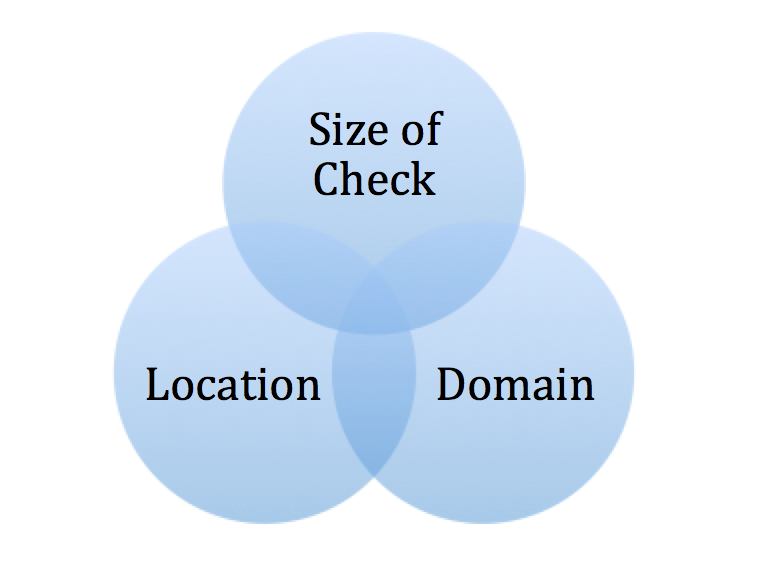

Instead, I advise startups to filter the list of potential investors by three critical criteria and only meet with an investor that matches all three. If an investor meets only one or two of the criteria, you are wasting your (but potentially not the investor’s) time. So what are these three criteria?

Size of Check

Perhaps the most important criteria, and also the most overlooked by a founder, is the typical size of check written by the investor. For example, let’s say your startup is looking to raise a seed round of a $1.5m convertable note. The typical scenario is that you have 3-4 investors, one lead at half the round at $750k and the other 3 investors in at $200k – $300k each. If this is the amount of money you are looking for, don’t seek out Angels who are only going to put in $25k-50k at a time or don’t seek out VCs that typically invest $25m or $75m in a round. The size of the check that they typically write won’t match up with what you are looking for.

Domain

Another common mistake is to hit up an investor who matches your check size, but doesn’t invest in your domain space. For example, let’s say you are a hard core B2B business and you approach an investor who only invests in consumer mobile apps, looking for the next Instagram. Big waste of time. What if you just finished your Kickstarter campaign on the next awesome IoT breakthrough and you approach an investor who has never made a hardware investment before. If they were even willing to invest, why would you want their money, they have no expertise in hardware? Instead filter only investors who actively invest in the space that you are in. They will add the most value since they understand your domain. In addition, they will have the most patience since by definition they are a believer in your space.

Location

Location is often is overlooked as a third matching criteria. I don’t mean your physical location, which is important to some investors-particually in Silicon Valley or a government backed fund, but rather the location of your target market and customers. If you are a startup targeting the Indian market, find an investor that is comfortable with that market and has an expertise there. You don’t necessarily have to find an Indian investor, but one where you are located that understands the Indian market and is not frightened by it and can connect you with the local ecosystem.

After you have applied your three criteria filters to your list of investors, now it is time to reach out and get those warm intros. Only then will the meeting be productive. Often times I get pushback from founders saying that they are meeting with Investor XYZ that meets two of the three criteria. I tell them that the investor is wasting your time. What they are doing is taking the meeting to learn about your domain or target market without having to invest. For example if Investor XYZ never invested in Africa and your target market is Africa, they may take the meeting to see what is going on in Africa and report back to their partners. For them a one hour meeting in their office hearing your pitch is a worthwhile use of their time to get educated for free.

Same if an investor typically writes larger checks, say $25-50m average, but also has a new “seed” fund. Avoid those investors at the early stage. You get very little synergy from the brand name and will never meet the famous partners. In addition, if it really is a seed fund and there is no avenue for follow on pro-rata, you are back to square one when you are pitching the “main” fund. Also, in some instances the “seed” fund at a larger fund is typically the “B” team-young partners recently hired who are thrown into the seed fund without any real influence at the senior partner level.