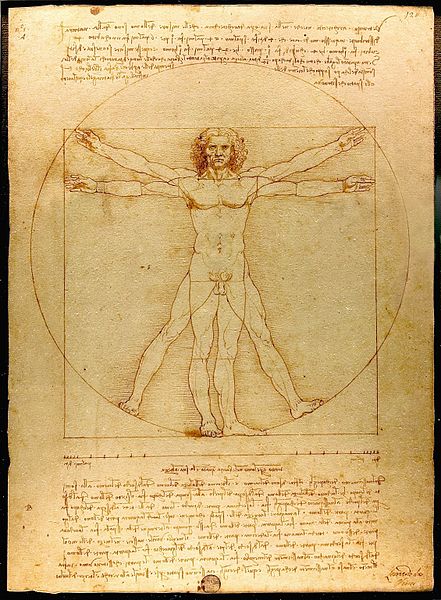

Leonardo da Vinci Venture Capital and Startup Lessons

Our firm name Fresco Capital is inspired by the timeless fresco paintings of masters like Leonardo da Vinci.

You may wonder “how can there be such a thing as Leonardo da Vinci venture capital and startup lessons?” as he lived hundreds of years before our modern startup ecosystem.

Yet Leonardo da Vinci left us a record of his observations and opinions in amazing notebooks. Many of his attitudes and habits are explored in How to Think Like Leonardo da Vinci. Here are five Leonardo da Vinci venture capital and startup lessons:

1. Curiosita: insatiably curious approach to life.

Curiosity beats raw intellect for anything related to startups because you need to keep asking questions. Once you assume that you know all the answers, the company is probably going to fail. On a related note, it’s hard to be curious about something when purely motivated by money. It’s much easier when you are driven for the sake of learning and money is the by-product.

2. Dimonstratzione: commitment to test knowledge through experience.

Learning through books and from others is helpful but there is no substitute for learning through experience. The scientific method of formulating a hypothesis and then testing it is extremely valuable during this process. Also, the experience of surviving and growing through the failures of experiential learning leaves scar tissue, which makes you stronger in the future. Of course, it doesn’t always feel good at the time.

3. Sfumato: willingness to embrace ambiguity, paradox, and uncertainty.

Startups are defined by ambiguity, paradox and uncertainty. There is never enough data or evidence to make any important decision obviously clear except in hindsight. Every choice has both pros and cons. Most of the time, the only choice is to move ahead into the unknown while maintaining an open mind about feedback just in case you need to change course quickly.

4. Arte/Scienza: balance between science and art, logic and imagination.

Some people get obsessed about the technology in startups. In the process they forget about people and emotions. True success requires a blend of science and art, and this is especially true in the early stages of building a company. To build something with global scale, a basic human emotion needs to be satisfied at some point in the value chain, even if it can be described by cold, hard logic.

5. Connessione: recognition and appreciation for the connectedness of all things and phenomena.

Nothing exists in isolation. Decisions, actions and results always have context. Startups by definition have limited resources and so it is especially important for them to leverage the surrounding ecosystem and do more with less. As part of that, systems thinking has to include a strong appreciation of time, including when to move quickly and when to be patient.

There are many modern theories about venture capital and startups but the reality is that the core principles for success have been around for centuries. These Leonardo da Vinci venture capital and startups lessons illustrate that he would fit right into the current global startup ecosystem.

Photo credit: Luc Viatour

Stop Trying to Imitate Silicon Valley

Planners from all over the world try to replicate the success of Silicon Valley with varying levels of success. Everyone from New York City (Silicon Alley) to London (Silicon Roundabout) to Hong Kong (Silicon Harbour) to Moscow (Skolkovo) has mimicked Silicon Valley in an attempt to build their own version of the lucrative startup hub.

The problem is that Silicon Valley has unique features that have allowed the region to become the world’s center of gravity for innovation. Simply copying the things that allowed Silicon Valley to become such a success won’t work, as some regions have already discovered. The tech hubs need to play to their strengths and evolve in their own unique ways.

Silicon Valley’s Recipe for Success

It’s easy to see why governments want to create their own version of Silicon Valley when looking at the valuations the California region is blessed with. There are now at least 74 startups there valued at more $1 billion each. The total value of these so-called “unicorns” is $273 billion.

The reasons for Silicon Valley’s success are many and most of them can’t be easily copied. Geographically, the region is perfectly located near San Jose, San Francisco, and Oakland. Historically, Silicon Valley has experienced decades of success with well-established companies like Google, Facebook, Apple, Fairchild Semiconductors, Intel, Tesla, and other esteemed companies.

In Silicon Valley, everyone knows somebody who has gotten rich off of stock options they think they’re smarter than…which in turn propels them to take a risk at a startup. Perhaps most important for the region’s growth is this competitive and creative culture that continues to allow so many companies to thrive. Not to mention, an endless supply of elite students from Stanford and Berkeley graduate (and dropout) each year to create the next crop of potential tech giants right in the Valley.

But this formula can’t be bottled upon and shoehorned in anywhere. The wealthy people in San Francisco might work at Google and the likes, yet in Hong Kong and New York, the upper class tend to come from finance, and in Los Angeles it’s Hollywood—hopefully you get the idea. This still doesn’t stop governments and business people from trying to replicate Silicon Valley without taking culture and demographics into account.

Being Unique: Playing to Your Region’s Strengths

Every would-be tech hub has its own unique characteristics and features that need to be taken advantage of. If you go to a Starbucks in Los Angeles, you’re likely to bump into a celebrity or similar entertainment personas. For Hong Kong or New York City, odds are high that you’ll fall into a conversation around recent market performance and SEC developments.

Playing to a specific region’s strengths helps lead to success. Modeling a hub exactly from Silicon Valley in areas that don’t carry the same characteristics becomes a major disadvantage. New York, Hong Kong, and London are better suited to be fintech startup hub than Silicon Valley. Los Angeles is better suited to be an entertainment startup hub than Silicon Valley. Playing to those unique strengths make more sense than trying to replicate Silicon Valley.

Fostering Growth

Government benefits are a welcome way to help foster startups, yet they’re only the baseline and not the endgame. All those helpful benefits (friendly tax policies, real estate deals, subsidies, incubators, etc) only go so far. The barriers of entry to create a tech innovation center in the vein of Silicon Valley are so high that these benefits are simply the table stakes. A bigger, greater hook is needed for regions to succeed.

Regions need to embrace what makes them unique and build off of that. With everyone trying to copy Silicon Valley, there’s plenty of room for new players with their own strengths. Any place that simply tries to do exactly what Silicon Valley is doing will pale in comparison to the original.

The Recipe for a Successful Ed Tech Ecosystem

Dynamic Founder Agreements

In my role at Fresco Capital and as an advisor to several startups, I’ve seen it all with founders: disputes over shares, disputes over money, disputes over a new laptop, founders break up, a founder falling ill, founders get married, founders get divorced, founders get into physical arguments. Often this leads to one founder completely disengaged from the business and still holding a significant amount of equity or even a board seat. We’ve seen this at large companies such as Microsoft and more recently at ZipCar. Typically you need this equity to hire executives or attract investors. Worse, if the company is being acquired, you now have one founder who can hold up the deal if they are on the board and disengaged. That of course is a problem, but one that can be solved with a dynamic founder agreement.

Founder Troubles

Most founders settle the division of equity question with a static founders agreement. It usually goes something like this:

Founder 1: 50%, vested over 4 years, 1 year cliff

Founder 2: 50%, vested over 4 years, 1 year cliff

This solves a lot of problems, such as if a founder leaves after two years, they will still have 25% of the company but give up the second half of their equity. What happens if one founder is not “pulling their own weight” or contributing enough to earn the vesting (in the other founder’s eyes) but did not leave the company? What happens if they have to leave due to illness or personal emergency? What happens if there is misaligned expectations as what skills a founder brings and what role a founder will play?

I’ve seen this happen at one of my own startups. One of our founders was a lawyer and at the time we sold the company, he could not represent us due to it being a clear conflict of interest. While the legal fees were not all that bad (maybe $50k), to this day, almost ten years later, my other co-founders are still mad at the lawyer co-founder. This was clearly misaligned expectations.

This is what Norm Wasserman calls the Founder’s Dilemma, or the unexpected consequences of not spelling out the roles and expectations of the founders early on combined with the unintended complications of a founder leaving early or disengaging. He suggests a dynamic founders agreement.

The Dynamic Founders Agreement

The dynamic founders agreement is a way to mitigate the risk of an underperforming founder by changing the equity based on pre-set parameters. For example say I am starting a company with my friend Sam. Sam and I agree to a 50-50 split with Sam being the “business guy” and me being the “tech guy”. The assumption is that I will be the coder of V1 and lead the development team after we get funding. But what if I need to leave the company due to family emergency? What about if I decide that I don’t want to code anymore, before we can afford to hire a developer? What if I only give 30 hours a week and consult on the side?

A dynamic founders agreement is a big IF THEN ELSE statement that spells all of this out. IF Steve works as expected, his equity is 50%, if Steve has to leave the company, if he becomes disengaged, here is the pre-negotiated equity and if we have to buy Steve out, here are the terms. For example:

IF:

Steve works full time as CTO performing all the coding and technical duties of V1, his equity is 50%, vested over 4 years, 1 year cliff.

ELSEIF:

Steve works part time, is disengaged, or we need to hire developers sooner than expected, his vested equity is reduced by half and he forfeits his unvested equity. Loses board seat.

ENDIF:

If Steve has to leave the company because he needs a job or a family emergency: if Steve built V1 then the buyout is a one time payout of $50,000 USD cash or 2% vested equity, if Steve did not build V1, the buyout is 0.5% vested equity. Loses board seat.

Having a dynamic founders agreement won’t solve all of your problems, however, it will make the the process of removing a founder much less stressful. Sure some of the language in the dynamic founders agreement will be subject to interpretation, but the “spirit of the agreement” is much easier to follow or even if you have to litigate, more robust. If you never need to use the dynamic founders agreement, but built one anyway, it will force a frank and open conversation about roles and commitment among the founders. This only strengthens the relationship between founders, increasing the chances of success.

The Hong Kong Startup Ecosystem: What’s Next?

Before looking at the future of the Hong Kong startup ecosystem, it’s important to begin with the past. The Hong Kong startup ecosystem has seen tremendous progress during the past five years.

The most important factor has been the entrepreneurs themselves. Without entrepreneurs, there would be no ecosystem. To build teams, of course additional talent has been needed, and Hong Kong has seen a strong mix of immigration and inspired young people. Next, capital from angel investors and real estate from co-working spaces has provided the the basic resources for starting a company. The first accelerator in Hong Kong, AcceleratorHK, was started by my partner Stephen Forte and Paul Orlando, with a wave of new accelerators now following. Education was added to the mix when my partner Allison Baum brought General Assembly to Hong Kong, and there are currently several options for learning the basic skills about startups.

So what’s next?

First, we need more of everything. More entrepreneurs, more talent, more angel capital, more accelerators, more education and, yes, even more co-working spaces.

Second, we need to pass the mom test. Right now, entrepreneurship has entered the consciousness of the younger generation in Hong Kong. That’s a great start. But to really make it go mainstream, we need to convince all of the moms in Hong Kong, including the tiger moms, that entrepreneurship is serious option for their children. Of course we need heroes, but rather than simply creating idols for worship, it is important to show these moms that entrepreneurship is a diverse ecosystem where people with different skills can find successful and meaningful careers. Joining a successful and fast growing startup as an employee with equity is actually more rewarding than being the sole founder of a project that never makes it off the ground. Working as a service provider who supports the startup ecosystem is a meaningful way to give back to society. Becoming a lifestyle entrepreneur can provide the flexibility for people to balance work and life. As a startup ecosystem, we need to reach out to moms all across Hong Kong and get them on board.

Third, we need private sector investors, limited partners, in home grown early stage venture capital funds. All anecdotal evidence, both formal and informal, suggests that startups are able to raise angel funding in Hong Kong but when reaching Series A they typically look outside of Hong Kong for investors. Not only is this frustrating for the startups, it creates a real risk for Hong Kong that these companies will scale up their operations elsewhere just as they reach the sweet spot of growth. There are many institutional investors based in Hong Kong, but their investment focus is traditional sectors like property, foreign markets or later stage growth capital. Other countries have successfully built up early stage venture capital based on the foundation of local limited partners. Hong Kong is already a powerhouse global financial centre with strong growth and late stage capital but to build a sustainable startup ecosystem the connection between finance and startups needs to be strengthened.

Let’s make the next five years of the Hong Kong startup ecosystem as productive as the last five. To reach the next stage of evolution, we need more of everything and also two additional factors: passing the mom test and local limited partners for early stage venture capital funds. As Hong Kong legend Bruce Lee said, “There are no limits. There are plateaus, but you must not stay there, you must go beyond them.”