Corporate Fakers, Takers and Makers

Imagine if your startup meets with one of the world’s largest companies to talk partnership. You tell them about your latest product full of excitement and passion. What if the following week they have a team working on a copycat product?

Danger

Large corporates have become much more involved with startups during the past several years. Especially the ones from Asia. And yet it’s difficult for startups to successfully do reverse diligence on these large corporates. Especially the ones from Asia.

Fortunately for startups, we’re doing that work on their behalf. Core to our model is finding the right corporate partners, especially in Asia, to help startups scale into local markets and provide other strategic benefits.

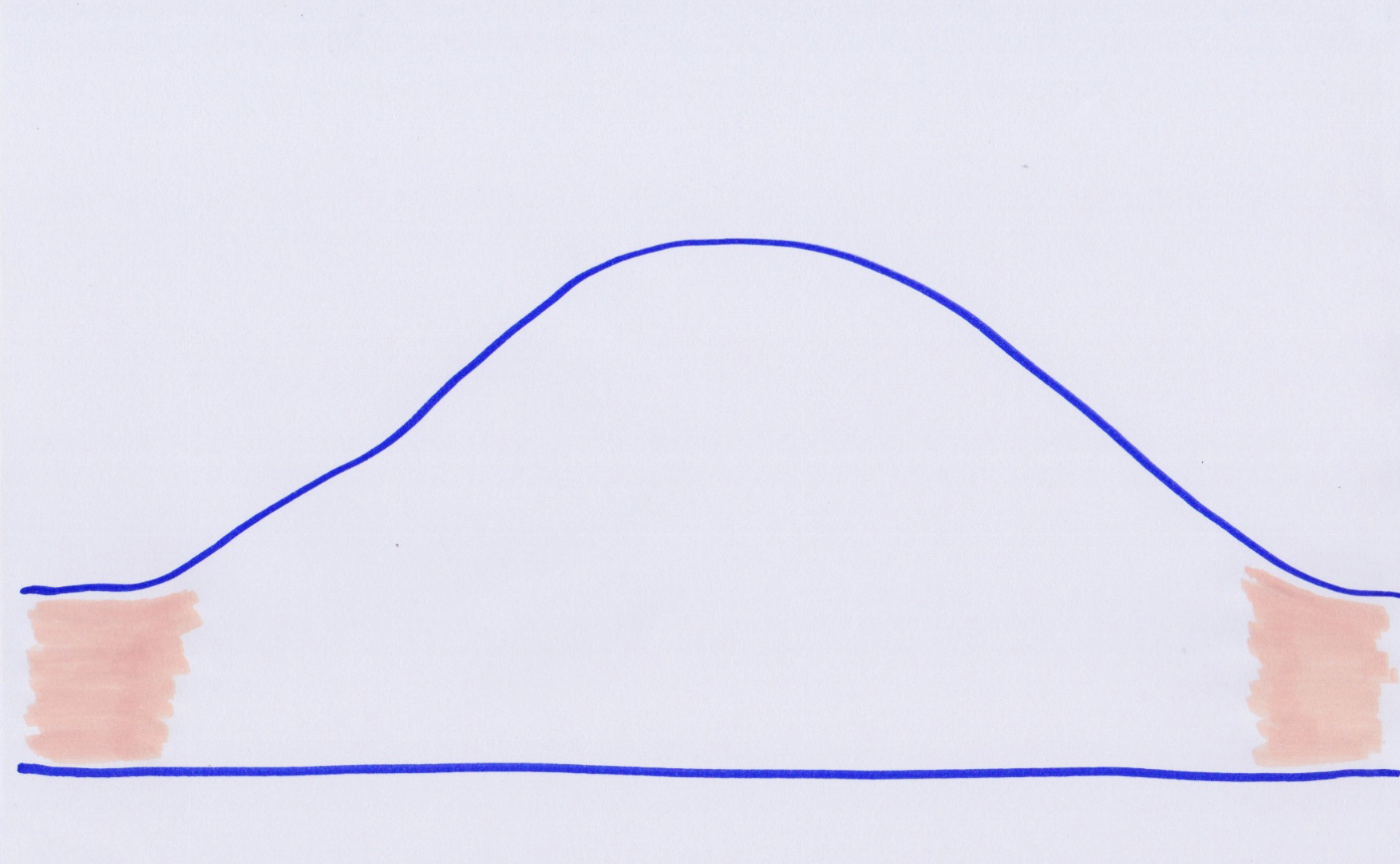

When startups pick the wrong corporate partners, it’s worse than nothing. Because takers and fakers can suck your limited time, energy and resources like vampires and zombies. They simply bleed your startup to death. And then move on to their next victim.

There are actually plenty of fantastic makers who know that their success comes from building the future with you. But connecting with them is hard. Here’s a rough guide to finding these makers, ignoring the fakers and protecting yourself from the takers.

Fakers

The discussion with fakers tends to start off strong. They typically know how to work the media and get favourable press coverage. They love to attend networking events.

And they name drop. Right away they let you know that they know people. Not just any people but the people who know people and the people who people know. They are also always busy. This combination makes them seem like makers at first.

Except they’re not.

Because when it comes time to actually get things done, fakers gonna fake. They have convenient excuses, mostly related to schedule. Because fakers are very busy…doing not very much at all. Fortunately, that reduces their ability to inflict serious damage. They’re so busy doing nothing that their main negative impact is the opportunity cost of missing out makers.

As long as you don’t get stuck in a long-term zombie relationship, the downside of fakers is usually limited.

Takers

You should be much more worried about the takers, which come in various forms and sizes. Some are famous names. Some hide in the shadows. Some are shape shifters.

What all takers have in common is a zero sum philosophy that for them to win others must lose. These are the companies that meet with startups and have a team copying the product the next day. They negotiate complicated legal agreements and then find a backdoor. They suck your blood as quickly as possible because that’s how they stay alive.

So what can you do?

The main thing to remember is that, no matter what, takers gonna take. So when you start spending time with them, you’ll notice an odd pattern. They’re constantly finding ways to suck blood from others. The most obvious habit is to take from people who are weaker, so watch how they behave around people who can’t help them or hurt them. In the early stages of speaking with you, it may be less obvious because you have something they want. But even then you’ll notice hints of their desire to take.

The reality is that many takers are in positions of power and you will probably have to deal with them, so be prepared and keep your option open to walk away if needed because the downside could be deadly for you.

Makers

These are the ones who get stuff done. Once a maker becomes well known, their challenge becomes time allocation. They simply have too many opportunities and too little time.

First, you need to stand out. Because you’re not the only one who wants to get their attention. This does not mean coming up with gimmicks, sending them messages every hour or shouting louder at events. It means understanding what the maker truly needs or wants and only approaching them if you have the answer. Otherwise, you’ll be wasting your time and energy.

But there’s another kind of maker.

Instead of targeting the makers who are already famous around the world, consider looking at the large number of companies who are also makers but less famous. How do you find them? Especially in Asia? Through a trusted network. There are many amazing maker companies who quietly build huge value for their customers, partners and themselves and yet are not famous.

The best part of working with makers who are less famous is that they will actually have more time for you precisely because they don’t have to deal with as many distractions.

Shortcut

Sadly, there will never be a way to get rid of all the fakers and takers. But we’re in a fortunate position to give startups a shortcut to work with trusted partners. This creates a competitive edge for you to build more value faster.

We connect makers with makers so you avoid the fakers and takers.