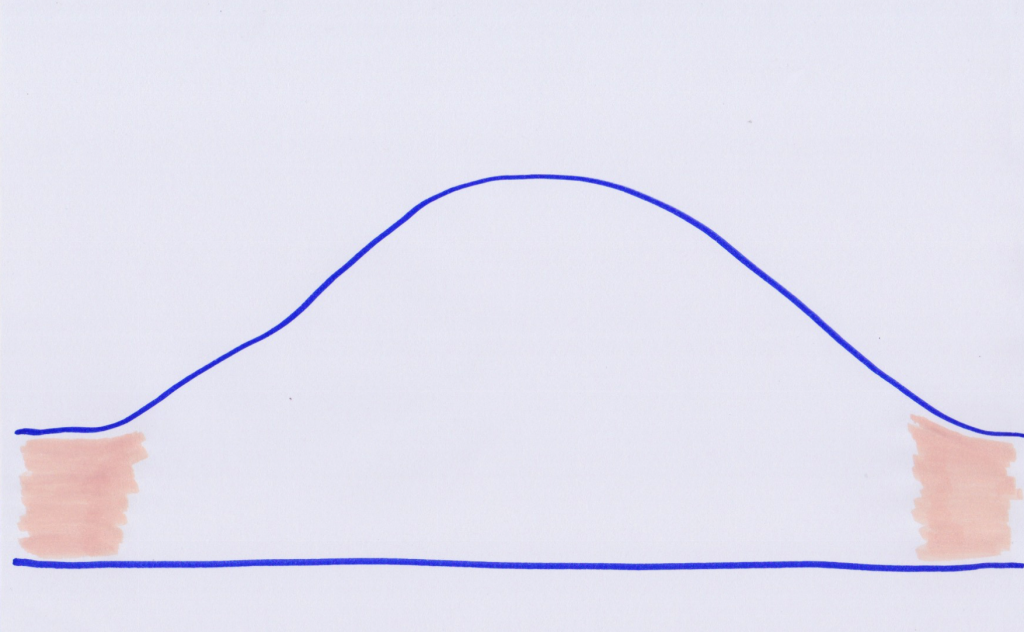

As venture capital investors, we are constantly looking for positive fat tails, companies that have the potential to generate extreme positive outcomes.

At the same time, not all fat tails are positive. There are negative fat tails. And as we look towards 2016 and beyond, it’s important to think about the risks. While there are many potential risks to consider, the following list of five fat tails focuses just on finance and economics because I don’t have the time to write a book this month.

To be clear, these are not predictions. In fact, the world may be better off if none of the following fat tails happen in 2016. But at least we should be prepared and resilient, just in case.

1. US dollar squeezes dramatically higher

If the US dollar rises steadily, that would not be a fat tail. But if it rallies sharply higher, that would fall into the category of fat tails. Why would that be negative? Historically, a strong US dollar is associated with tighter liquidity conditions globally. And so if we see a sharply stronger US dollar, that will be a clear warning sign of potential risks ahead. Currencies are typically the first financial markets to move. They lead bond markets, equity markets and private markets. As an early warning indicator, keep an eye on the US dollar. If it squeezes higher, get ready for more fat tails.

2. Unexpected rise in interest rates

The last interest rate increase by the Fed was in the summer of 2006. At that time, Facebook was only open to students, the iPhone had not launched and Tesla was an early stage startup. An entire generation of young people has grown up without understanding what happens when interest rates rise. An entire generation of old people has forgotten what happens when interest rates rise. It’s highly possible that we’ll finally find out in 2016. Historically, rising interest rates could not be called a fat tail event because this was a normal cyclical process. But if there is an unexpected rise in interest rates during 2016, it is best to approach this as a fat tail event because we really cannot predict how the results will play out.

3. Unicorn contagion

In every cycle, certain ideas capture the essence in a single word. In the current cycle, Aileen Lee’s concept of unicorns is that word. Now that some of these companies have started to show signs of being less than perfect, their connection as unicorns creates the risk of contagion within the group. More broadly, it’s still unclear what weakness within the group would mean for the broader startup and financial ecosystem. Perhaps nothing. Perhaps they are a leading indicator. At the very least, it’s worth keeping an eye on sentiment around unicorns.

4. Crowdfunding backlash

Crowdfunding is a transformational and positive idea overall. Like any transformational idea, markets have a habit of taking things too far. We’re now seeing new crowdfunding sites pop up weekly and some of the players are using very aggressive marketing tactics. There will inevitably be fraud, so the only question is the magnitude and the level of backlash. The fat tail event would be a larger than expected level of fraud, which would then lead to a strong backlash. This could impact both crowdfunding itself and also fintech generally. Compliance is already one of the fastest growing job in the finance sector. Unfortunately, a fat tail event in crowdfunding could accelerate this trend.

5. The Euro breaks up

Politically, it seems unthinkable. To be clear, this is not expected to happen in 2016, but it needs to be considered as a fat tail risk. If the Euro were to break up in some fashion, that would be the unwinding of a trend not simply going to the start of the Euro itself, but many decades earlier. The impact would be felt by everyone and while financial markets would take a back seat to the social issues, there would clearly be a massive impact on financial markets as part of the process.

The paradoxes of fat tails

Fat tails are full of paradoxes. The good news is that, individually, each of these events are unlikely to happen in 2016. The bad new is that fat tails are not independent. A stronger US dollar may actually happen along with an unexpected rise in interest rates and this in turn could trigger a unicorn contagion, a crowdfunding backlash and even a Euro break-up. And so, rather than thinking about them as five separate fat tails, we need to be aware of the possibility that they could cascade into one giant fat tail.

Fat tail events are almost impossible to predict. The only consistent prediction is if you can stay resilient during negative fat tail events, you’ll be around to take advantage of the remaining positive fat tail opportunities.