Why I have a portfolio career, as a Venture Capitalist

By Eriko Suzuki, Partner at Fresco Capital

I am a portfolio worker and a Venture Capitalist.

I am both Partner at Fresco Capital, a mission focused global early stage startup investor and Director at Mistletoe’s Investment Group, a social impact investor founded by Taizo Son, the younger brother of Softbank CEO Masayoshi Son.

As we all know, new ways of work have been evolving. The financial crisis which occurred exactly 10 years ago, propelled employers to look for lower cost labor and employees to think more flexibly, and their needs were matched and enabled through the development of digital platforms. Today, we not only see freelancers who work from project to project, but also parallel workers or portfolio workers who take on multiple tasks and roles simultaneously. Such ways of work are now more proactively embraced by millennials and generation z cohorts who value work flexibility.

Yet, even in the US and Silicon Valley, I have not come across a fellow portfolio worker or “contributor” type Venture Capitalist.

How did I get here?

I personally “strumbled” (a combination of struggling, hustling and stumbling) into this portfolio worker career, through my journey to find meaningful work whilst also raising a family.

I started my career in investment banking as I wanted to acquire business skills to one day build a socially impactful enterprise. I also had my first child and worked banking hours whilst raising him, but eventually decided to join a large global luxury retail company for more manageable hours. However, the 9–5 arrangement put me on a “mommy track”, and I felt unable to gain the deep operational experience to one day launch that social enterprise. So I jumped on the opportunity to bring a US drone startup to Japan as country manager.

Then, as the startup pivoted and I searched for my next “gig”, I stumbled upon Mistletoe, a social impact VC at which I could combine my skills in finance and technology to support socially impactful businesses.

It was finally finding this ideal job, that gave me the impetus or a no more excuses attitude, to make things work. At the time of my joining, Mistletoe did not have any employees working flexible hours etc., but I set about to make such a culture.

This experience lead me to write my book, “How we live will be how we work” (Daiwashobo, 2018), in which one of the key message is to find work that you are passionate about, and make work work.

Soon after, I also joined Fresco, to further pursue all of my passions, and become a portfolio worker VC. At Fresco, I am able to support mission driven global minded entrepreneurs through a more traditional VC investing model and also help bring about large scale change by helping our investors which are large corporations better embrace technology and innovation.

Why portfolio working is the future

I am truly grateful that Fresco and Mistletoe appreciate me for walking the walk as an investor in future of work trends, and I personally swear by this portfolio worker VC career.

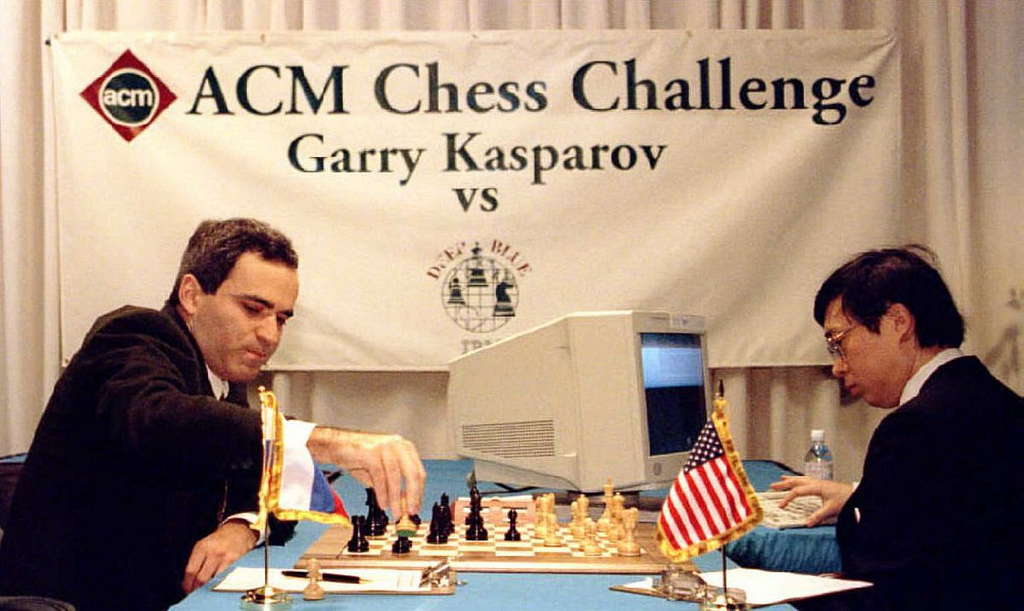

It was on a recent panel at a Tech in Asia conference, that I became even more convinced.

The panel was on “Japan’s startup ecosystem” and as we were joined by the Chief Strategy Officer of a large VC firm and early investor of Mercari, a flea market platform which recently went public only 5 years after its establishment with a $3.6bn market cap, we had all anticipated to talk about “hot” investment trends or latest exits, etc.

Instead, we spent 30 minutes talking about people and one of the key points of the panel was that “winners” like Mercari is increasingly hiring portfolio workers. The best people are often already hired, but can be convinced to join other projects on a part time basis, and such people contribute significant value even in a this part time capacity.

In fact, attracting such multitalented polymaths through attractive work environments, is the key to growth and success, even for all of Japan’s innovation ecosystem.

Companies or projects which do not allow their employees to work flexibly and do not hire portfolio workers will see their demise as they will further and further be disabled to hire and attract talent.

We are in a world where the winners-take-all the best talent.

I also thought this can be true for the ones being hired as well.

Recently, I have been contemplating taking on yet another portfolio work, particularly in the crypto/blockchain space which I am also passionate about.

Very luckily, I have received several offers to join exciting teams and projects even in my part time capacity. Extrapolating from my lucky scenario, I wondered if we are entering an era in which a few highly qualified individuals will hold multiple portfolio roles at multiple organizations, while others may not even be able to get a single role.

Multi-hired individuals will enjoy a network effect of sorts, because through their multiple roles, they can accumulate more networks, connections, and information which will also enable them to be more sensitive to the winds of the market and acquire the best and most updated know-how and skills.

On the contrary, individuals working on only one role might have less opportunities to update their skills and thus can more easily become irrelevant or outdated.

The hired get more hired.

A winners-take-all-jobs world.

Of course, there is a finite number of portfolio work one person can take on, at least with the current state of human augmentation tech. Nevertheless, while we shun the giant Amazons and Facebooks today (and hence my fascination with blockchain decentralized technologies which help to disintermediate such forces), we may indeed enter the era of GAFA of people instead.

Whilst I prefer to see a world in which almost everyone is involved in several projects across the globe which are most fitting to them, which are relatively evenly disperesed and equitably decentralized, we may indeed see “superpeople” who become contributors to multiple projects and even run companies, foundations, build products, designing, etc. all at the same time all to themselves.

How to be a portfolio worker

So what should we do?

The message is simple.

Start flexing your portfolio worker muscles sooner rather than later.

Start small, as indeed juggling multiple roles is not easy and context switching requires focus and self-discipline. One could even start for probono projects or by working on small moonlighting hobby passion projects

I am also still learning and iterating these processes.

However, I believe one of the most important skills are open and active communication.

I personally strive to have open and real time communication on job descriptions and KPIs.

Open and transparent communication is also important in clarifying access to information. In lieu of bureaucratic red tape and overzealous firewalls, we can cultivate a culture for respecting security and confidentiality. For my personal case, I openly communicate to our portfolio companies that I work for more than one VC and that should they feel any conflicts or concerns, I will seek their guidance and thoughts.

One might also think that heavy self promotion and branding is necessary for portfolio work.

Though it may be true, I am an introvert and often feel very uncomfortable doing such things, so instead I try to be hyper-authentic. I openly express both perhaps my strengths but also my weaknesses and vulnerabilities, and luckily, I have found that this has lead to building more sincere networks and long-lasting relationships.

Finally again, I am still learning, and am bound to make mistakes.

However, I also try to embrace this fact. We are all pioneers in this new way of work.

And as I say “we”, I hope to connect to more people in this way of work.

If you are a closeted portfolio worker VC please reach out.

Additionally, we at Fresco invest globally in the future of work, so if you find such platforms for the future, which I would imagine will be decentralized and equitable platforms which highlight each individual’s unique skillsets and experiences and connect them to projects globally, please also reach out!

An image of an opening inviting to another space, or is it a guiding minaret?)

Why I have a portfolio career, as a Venture Capitalist was originally published in Fusion by Fresco Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.